INFORMATION

Client Relationship Summary (CRS form)

ADV Part 2 A

ADV Part 2 B

Portfolio vs Funds

CFI Enhanced Yield Muni Bond Composite Disclosure

CFI Fact Sheet

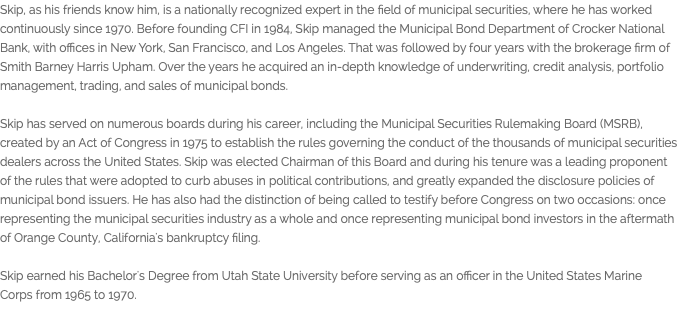

CHARLES FISH INVESTMENTS, INC. (CFI), founded in l984, is a Registered Investment Adviser with the Securities and Exchange Commission under the Investment Act of l940. CFI is an affiliated subsidiary of Brentview Investment Management, LLC. CFI’s revenues are derived exclusively from the fees received for the investment advisory and/or management services provided.

© 2023 copyright by Charles Fish Investments All rights reserved. Website design by TC Two Creative